There has been a tremendous amount of discussion around the topic of measuring Engagement. I have also had a lot of one-on-one correspondence in and around these topics through e-mail, and while thinking through all this, realized there’s a lot going on but there may be a can’t see the forest for the trees” scenario building here.

In other words, the discussion is so focused around Tactical measurement issues that folks may not be seeing how “Engagement” is an important part of a much bigger Strategic idea, and that fact should influence the way people think about Engagement, if this whole concept is ever going to be more than just a pile of exotic Tactical metrics lying around.

Now, I realize people want to measure Engagement, particularly on-site Engagement, for lots of different reasons that may not have to do with Marketing Strategy. I think it’s the nature of people with technical backgrounds to think very Tactically. Many of these folks are more concerned about usability or something closer to “customer experience”, or the general appeal or stickiness of a web site. And that’s certainly OK with me, and important work.

But this post is not for you folks.

This post is for the more Marketing-oriented analysts and managers, many of whom have technical backgrounds and have done an amazing job of learning about Marketing. Really. I wish Marketing folks would take the time to learn as much about Technology as these technical folks have learned about Marketing.

Marketing is much more than the Tactical stuff, like Advertising, Branding, conversion, and all that. At least to some of us old folks. Marketing has traditionally had a Strategic role, which means it sets up the business model and ensures that the “product”, whatever that is, directly addresses the marketplace and audience, that the product is built to sell – and stick.

Those of who are interested in Engagement from this more Strategic level of Marketing, this post is for you. And just as an aside, we’re not talking about fuzzy Branding and social media Engagement stuff here (You’ve got to engage your customers! Really! It will be good for business!), we’re talking about real world, provable, profit and loss Database Marketing (here’s how to increase profits by measuring and acting on Engagement).

In the mid-eighties some academic folks published thought pieces around a data-driven marketing approach they sometimes referred to as Relationship Marketing. In 1992, a pretty famous Silicon Valley guy named Regis McKenna published a book called Relationship Marketing, which put forth a framework and real life examples of how it all worked, mostly focusing on B2B.

Essentially, the idea behind Relationship Marketing is that rather than segmenting customers by age, income, product, and so forth, you segment them by where they are in their relationship with the company; you create a Marketing Strategy that is customer-centric instead of business-centric. The core Strategy was this: if you communicate with customers based on where they were in their Relationship with the company, the communications would be more relevant to the customer, so your marketing would be more successful and profitable over the long run.

Customer-centric. Relevant. I’m not kidding. Check it out on Wikipedia if you don’t believe me; you will be shocked at the concepts and language used. It all should sound very, very familiar to you when you read it!

It gets better. To do this Relationship Marketing thing properly, you have to understand what the Customer LifeCycle is. Lifecycles are literally a measurement of engagement and dis-engagegment between the customer and the business. The idea was if you could measure these engagement / dis-engagement cycles, you could tell when things were going well or poorly between the customer and the business, then proactively take action to correct problems and issues. Further, if you got very good at recognizing these cycles and patterns, you could actually anticipate / predict problems and take corrective action before the customer had a negative experience.

So it’s 1993, and I’m sitting in the middle of the greatest interactive experiment to date on the consumer side – Home Shopping Network. And I’m thinking, if this Relationship Marketing Strategy works so well in B2B, why wouldn’t it work for B2C? The data will be different, the metrics different, the trigger behaviors different, the Tactics different, but the Strategy, the Relationship Marketing Strategy wouldn’t that work? Particularly when we’re so interactive with the customer? Shouldn’t it work even better when there is direct and sustained interactivity with the customer?

You wouldn’t believe how well it worked, at many different levels of the company. Customer Marketing programs with unimaginable response rates. 90-day ROMI numbers of 400% or better on a consistent and sustained basis – using offline marketing. That’s how well it worked. The magic of using Control Groups to measure campaign profitability allowed us to capture every bit of incremental profit that was derived from re-engaging the customer – even if they didn’t respond directly through the campaign itself, but through another channel.

So, these conversations about customer-centricity, relevance, and engagement have been taking place for over 20 years in Marketing Strategy. The challenge with this model – and probably why it isn’t more widely known – has been the data, it’s a very analysis-intensive model, as you might expect.

In B2B, McKenna’s ideas grew into what is now known as Contact Management or Sales Force Automation. On the B2C side, I guess CRM was supposed to be the ticket, but somehow (until recently) these folks forgot about how critical the analytical part of the equation was to the success of the Relationship Marketing concept.

As far as online goes, we have the data, but until fairly recently the online space has been so all about Brand and Advertising, not Relationships. Now the Web has decided it will be all about Relationships, which is very cool. The web is perfect for that approach, (um, can you say interactivity?) and it’s perfect for a Relationship Marketing Strategy.

Like I said, I’m sure there are quite a few different reasons why folks want to measure “Engagement”, and not all of them have to do with Marketing. But if you are talking about Engagement as a metric to be used in Marketing, now you have the complete framework for why (as opposed to how) it is so important to measure Engagement – to define the LifeCycle of the customer, in order to communicate and act in the most customer-centric, relevant way possible.

The LifeCycle is about both Engagement and dis-Engagement. If you are in the Marketing camp, you can’t just talk about measuring Engagement. After all, if Engagement is really important and valuable, then dis-Engagement has to be really important and valuable in the opposite way – it’s a bad thing. Dis-Engagement means, literally, that your company is no longer relevant to the customer.

In some businesses, online display advertising for example, it’s not clear that dis-engagement really matters, at least in the current model from the perspective of the advertiser. Hey, an impression is an impression, right? Who cares what happens after that. At least they’re talking about some kind of engagement metric? – Duration – which should relate to the quality or the likelihood of an impression. Not much more they can do, in my opinion, for that business model. But from the perspective of the site owner the ads run on, dis-engagement should be a “big deal” – especially if you paid something to get that visitor to come to your site in the first place.

So, we have Engagement, and we have dis-Engagement, which it seems nobody ever talks about. I sincerely hope that changes in the future as we move forward.

Now, how do we track the LifeCycle, how do we actually implement? It’s really very simple in concept:

1. Define / Measure Engagement – any way you want to, as appropriate for your business; whatever activity or combinations of activity you feel appropriate

2. Measure dis-Engagement – the absence of Engagement, as in the visitor / customer stopped doing whatever it is you define as Engagement for your business model

3. Take some kind of Marketing or Service action to slow or reverse the dis-Engagement with dis-Engaging folks

That’s not very hard, is it? No.

However, even when you get the LifeCycle and learn to react to it, the system is not optimized yet. The Relationship Marketing Strategy is not optimized until you start predicting dis-Engagement, and taking action to try and re-Engage the customer before they completely dis-Engage. Because once your company becomes completely irrelevant, it’s very hard to change that for the visitor / customer – much harder than if you act before or when the dis-Engagement is occurring. You can’t have an”annual re-Engagement campaign” and fix this – you have to fix it as it is happening, meaning you throw out all calendar-based communication and communicate based on where individuals or segments are in the LifeCycle.

Fortunately, dis-Engagement is usually a process – unless the company screwed up in a really big way. And this dis-Engagement process is fairly uniform and actually quite easy to predict with simple tools. The company most often becomes irrelevant to the visitor / customer over time. In other words, the company gets second chances, the customer often gives the company leeway to become relevant again. So as a company or analyst, the key is to:

1. Recognize dis-Engagement has begun with a customer or segment

2. Have a re-Engagement plan and implement the plan before the company becomes irrelevant to the customer

I’m pretty sure most people reading this know what comes next – how to measure dis-Engagement and act on it – given I have plastered this information all over my blog and web site. If you don’t know how to predict dis-Engagement and the triggers you can use to take action, this is a good place to start. Depending on your business model, you should probably also take a look at what Theo proposes in terms of Kind and Degree for survey work once you have dis-Engagement behavior as a trigger for the survey.

For most web sites, regardless of what you are using as a metric for Engagement, a good clue the dis-engagement process has begun is when a visitor stops visiting, posting, commenting, buying, or whatever is key to generating value on your site. The challenge is you have to recognize this non-event has occurred right away, because the longer you wait to try and re-Enage the visitor / customer, or ask why they are dis-Engaging though a survey, the less likely it is you will be successful. And in case you are wondering, those of you with e-mail tactics that consist of relentlessly pounding your list with the same messages and offers regardless of visitor / customer behavior are not addressing the re-Engagement issue – trust me. Think about it.

Let’s take a specific example to show you what a Relationship Marketing Strategy looks like in action. I have stated, for example, that email is both taking credit for sales that would have happened anyway and generating more sales than you think it is.

These statements are both accurate at the same time. When you use Control Groups to measure the incremental behavior generated by e-mail campaigns, what you find is both effects occur at the same time but each one happens with a completely different behavioral segment – Engaged versus dis-Engaging. Unfortunately, in most cases, the net effect is e-mail falsely takes credit for more sales than it doesn’t get credited with accurately, because the Potential Value (future buying power) of the Engaged is greater than that of the dis-Engaging.

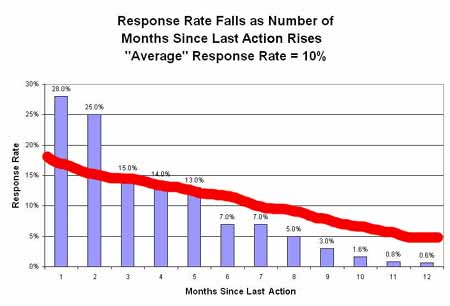

Against a graph of Response by how long ago the last click in an e-mail occurred, these dual effects on the actual response rate of an e-mail drop versus control group look something like this (red line).

Click picture to enlarge:

On the left we have the highly Engaged, and moving to the right, the pattern of dis-Engagement. On the left, we have a much higher percentage of “would have bought anyway”, which decreases as we move to the right. The portion of the blue bars above the red line represent buying activity in the control group – they bought without receiving an e-mail.

As we move to the right, this effect decreases, until the blue bars are now below the red line. The space between the blue bar and the red line represents sales made because of your e-mail that were not tracked back to e-mail. Often, this is a result of simply not tracking the “campaign tail” for long enough, which is difficult to do without using a Control Group to find the long-term lift.

The implication: for commerce, you should be sending a different message to these different behavioral segments depending on where they are in the LifeCycle if you want to maximize profit. In the segments with highest likelihood to buy, you should take it easy on the discounts; one way to optimize commerce profit across the entire engagement spectrum is to use a Discount Ladder.

For all other business models, it’s highly likely that you could benefit from the same approach, if you have clear value KPI’s and understand this dis-Engagement process.

Now, I am well aware the above sounds insane to offline retail folks. Most if not all of you lack the data to measure these effects, but that doesn’t mean they don’t exist. For the folks that do have the data yet, the day will come. Hey the web is interactive, the web is different, right? Well, yes it is, so why measure the effect of promotions like they do offline if you have a superior method of optimizing for profit

When a visitor / customer is highly Engaged, they often generate visits or sales without needing any Marketing at all. That’s what the Relationship Marketing Strategy is all about – the Relationship drives the business. That’s why, for example, people have found that including a lot of relevant and customer-focused content in a commerce newsletter gets higher response rates than just sending people coupons. It’s why creating a new customer kit drives higher repeat purchase rates – it’s the Relationship building. And that’s why you will find (if you use Control Groups) that for the highly Engaged, your e-mail program is taking credit for sales it did not generate, and that if you are providing discounts to the highly Engaged, you are probably wasting money on them.

A portion of the Engaged segment would have bought anyway, and the fact that you dropped a coupon in their lap with e-mail is simply coincidence. Or, if you send a coupon every week on the same day, the customer simply waited for the coupon they knew they were going to get so they could make a discounted purchase they would have made anyway at full margin. That’s how e-mail takes credit for sales it does not generate, and anybody who is managing to ROI / profit should care deeply about this.

Now, if you’re a “share” thinker, this subsidy cost related to “would have bought anyway” doesn’t matter to you, because any sale the other guy didn’t make is a good sale. But last time I looked, you can’t put share in a bank account, and the logical extension of this share mindset is you can get 100% share by selling product below cost, so I have never understood it. If your directive is increasing gross sales, that’s pretty much the same thing – you get there by unproductive ad spending, which in the end is the same thing to the bottom line as selling product below cost.

By the way, I’m not saying the Engaged should receive no communications, but they should get a different kind of communications tailored to their behavioral state.

On the flip side, no matter what your directive, you should care about not getting credit for sales your e-mail generated. E-mail to another segment, those in the process of dis-Engaging, almost certainly generates sales you are not tracking and not crediting to e-mail. And that’s because the dis-Engaging are changing their behavior with the company for some reason. They are seeking alternate channels, for example. In other words, they are responding to your e-mail but they are not responding through your e-mail, they are not using whatever devices or links you give them in the e-mail but are still making a purchase because of the e-mail. Again, you don’t see this unless you use Control Groups.

A third segment, the dis-Engaged, doesn’t respond to your e-mails at all. And they’re not going to, because your company is now irrelevant to them.? The company has not been tracking the dis-Engagement process so it didn’t take any specialized action to slow or stop the dis-Engagement. In fact, the company is probably just damaging their Brand by sending these folks any e-mail at all.

This is Relationship Marketing Strategy; it completely redefines how you communicate with customers based on where they are in the Engagement / dis-Engagement cycle. And it works amazingly well. The bottom line is customers remain customers longer – this Strategy tends to extend the LifeCycle, with the result customers end up with higher LifeTime Value.

Are you surprised? You shouldn’t be. People talk about this incessantly on the web all the time, don’t they? Relevance? Customer centricity? Customer experience? Blah blah blah?

Then how come so few people are using a Relationship Marketing Strategy? How come so few are using Control Groups to measure the true net influence of e-mail? Why are people blasting out the same irrelevant message to all their customers once a week? A lot of talk and very little action, methinks. Perhaps you just needed a framework to put everything into perspective, a roadmap to getting it done?

Now, I realize many folks in the community don’t have the tools they need to measure dis-Engagement; typically only the high-end tools have metrics like Recency and Latency and even though Google Analytics tracks Recency, it isn’t easy to do much actionable segmentation for that metric in the tool.

There’s a very simple reason for this, if you think about it – it’s a lot harder to measure something that doesn’t happen than measure something that does happen. After all, servers are all about requests, they’re not really thinking about “did not request”, if you know what I mean. That job takes a database that’s remembering the last date a request was made forward in time, and calculating “did not request”. That capability is a lot more expensive, at least for now.

But, I hope the “tool problem” doesn’t mean the community will ignore the concept of dis-Engagement while screaming to the skies about how important Engagement is to measure. Those of you with access to a transactional database don’t have to wait for web analytics tools, you can profile customers for Engagement and the dis-Engagement process right in the transactional database with a simple query tool. And I hope you now have a Strategic framework to think about why dis-Engagement is so important, at least from a Marketing perspective, so when you get your hands on that high-end tool, you will know exactly what to do with it.

If you really take some time to think about the ramifications of the Relationship Marketing Strategy that Engagement is a Tactical part of, you just might come to believe that dis-Engagement is even more important to measure than Engagement.

To summarize this series, the idea of Engagement, and a lot of notions surrounding it – customer centricity, relevance, and customer experience – are concepts within a Marketing Strategy known as Relationship Marketing that tosses out calendar-based communications in favor of communications based on the customer’s relationship with the company. The ability to do this depends on an understanding of the Customer LifeCycle, the results of each interaction between the customer and the company over time. The LifeCycle is tracked using various Engagement metrics, including dis-Engagement, which typically is the first sign of a problem with the customer Relationship.

If your company is having trouble understanding why Engagement is important to measure, perhaps it’s because senior management lacks the context of the Customer LifeCycle for taking action and the strategy of Relationship Marketing as a game plan. Maybe you should send a link to the Wikipedia definition of Relationship Marketing to the CMO or CEO and ask, “Is this what you want? Because if you do want this, I know how to measure the success of it”.