Jim answers questions from fellow Drillers

(More questions with answers here, Work Overview here, Index of concepts here)

Topic Overview

Hi again folks, Jim Novo here.

Have you ever offered a $100 off coupon to a new retail customer? I have. And guess what? There was no response, even though the average order size across all customers was $38!

So how is this kind of situation possible? Some products attract customers that are only interested in that product, and they are not going to buy again – period. Knowing this, the question for you: is this the kind of product you want to constantly feature / promote?

Guess that depends on the Drillin’, eh? Let’s get to it …

Creating Effective Retention Campaigns

Q: Hi Jim,

Love your newsletters. Do you have a tip jar I can use to donate to the cause?

A: Hmmm…maybe I ought to start one…nah. It all works out in the end!

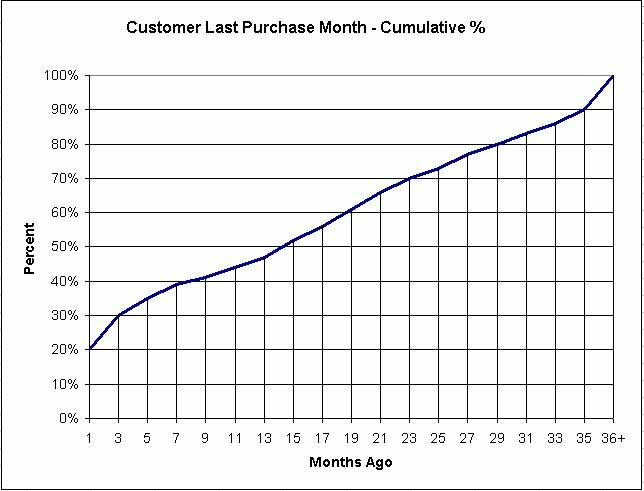

Q: Take a look at this chart I did of cumulative customer purchase Recency (actual numbers changed but the relationships are same): See below for explanation **

** Jim’s Note: How to read the chart:

“In the past 3 months, (“3” on horizontal axis), 30% of our customers have made a purchase (“30%” on vertical axis). In the past 7 months, almost 40% of our customers have made a purchase. Because the last category is “last purchase 36 months ago or longer”, the chart includes all customers – 100%.

Since each customer can have only 1 “most Recent” purchase, each customer is on the chart only once. Therefore, if 40% of customers have made a purchase in the past 7 months, 60% have not made a purchase.

Q: What does this pattern (the % of total by group) tell one generally about the attrition in the business model? It’s interesting, I’ve never looked at this kind of diagram before. For our business (wine retailer with “club” option), I generally consider anyone with a transaction in the past 12 months to still be a customer.

A: Wow, that is some set of numbers. If it mimics reality, that’s one smooth curve, which is typical of online. What you are seeing is a clear demonstration of what happens when you take “friction” out of the customer interaction equation. Offline, the curve is usually “lumpier” than this due to higher transactional friction. I would love to use this in a case study….or maybe the next newsletter…would hide the source, of course.

Anyway, there is nothing very surprising here for your type of business, customers roll off on a regular, gradual basis. I seem to remember a sub-segment from previous conversations that cancels the “membership” but still buys from the store. Now that you have this info, it might be worth it to make a segment there.

In other words, the “start” date for this sub-segment would be cancellation of membership, then look at last purchase date as was done here. It’s quite likely the two segments behave differently. In your initial test, you might want to look at “last purchase date as a member” if you can.

So you get two curves, one for “members” and one for “ex-members”. Kind of gnarly from a query-writing point of view, but there probably is a significant difference in behavior, meaning an opportunity for higher ROI. They are on one curve as a member, with one “highest ROI promotion point”, then when they quit and become a “store buyer”, they are on another curve, with a different High ROI promotion point. See what I mean?

Q: Now I just need to think of a really attractive promotion I can use to reactivate some of these defected customers :-)

A: Ah yes, the “how to act correctly” on the data. This is the single largest challenge folks have now. It’s great to finally have the data, but many simply don’t know what to do with it.

Since you were generous enough to share this data, I’ll give you some ideas. Keep in mind I really don’t understand your business other than looking at the web site, so I have a pretty good idea (love the home page copy, BTW) but I don’t know margins, distribution costs, etc. For that kind of analysis, you gotta “donate” something ;)

Generally, you first need to define your true defection point; the number of months beyond which it makes no sense at all to spend on the customer. Then you can fine tune from there.

This process is really about defining “economic defection” – regardless of whether the customer has “actually defected”. To me, that whole discussion about whether the customer has defected or not and how to define it that the CRM navel-gazers are always having is pointless. It doesn’t matter.

And the reason is this: if I can’t increase the profits from a customer, then there is no reason to spend anything on them or to even consider them a customer at all. Right? So whether they “really defected” or not is not an actionable piece of information, there is no profit in knowing the answer.

First, I would exclude anybody who bought in the past 3 months. The attrition rate here is pretty slow, and you don’t want to promote to people who have a good chance of buying anyway. You can always go back and retest them later after you study the buying patterns of this group in more detail. Early on, things like media source can dramatically affect continuation, so “brand new” or active customers are a different game.

Second, you don’t want to make it “too easy”, you want real proof any responders from a particular Recency segment still have potential value, you want them to work a bit to get the reward. The first time you do something like this, you are bound to lose money, it’s the cost of gathering the data now that will later allow you to be more profitable.

I don’t know what other promotions you do on a regular basis (e-mail?) but you want to go above and beyond that “usual fare” when base testing for economic defection. If you offer 20% off certain products in a regular e-mail, this promotion should offer 40% off, that kind of thing. If you don’t already do any regular promotions, you can go easier, say 25% off, free shipping, etc.

Either way, you also want them to engage in some kind of affirmative behavior, not just chase price, so you toss in a kicker – if you re-activate membership, for example. You want them to take some concrete action, that is the point. “Response rate” is not the goal here, this is a test of potential value and the data generated feeds longer-term strategy. You don’t want high response, you want the response **from the right people**.

Third, consider jumping “outside” the web. When an online business sends a postcard or a letter, it has a dramatic initial effect. In your business, I’d guess the impact would be even higher, given the product. Good thing about the web is it is easy to start a relationship, bad thing is it’s just as easy to drop one. So going with a postcard or “personal” letter will really load up your guns.

The idea behind #2 and #3 is to “throw the book at them” so when you get to a Recency segment that has no response at all, you are very confident they are defected. At the same time, you structure the offer so that you screen out low potential value participants.

Side story: At HSN, I once sent out a “$100 off anything” coupon to a new customer segment I knew had defected but nobody believed me because I was declaring them defected at 30 days. Zero redemptions. End of argument. And end of that product as a “featured item” because it “drives new customers”. Right, drives new customers of such high quality that they can basically order anything from us free using this offer and they don’t. How about offering something that creates new customers that are also repeat buyers? Duh.

Something wrong with that picture…

Fourth, I’d make the offer product-based in a big way – a “special” wine, best you have seen for the price, category, whatever it is. Even though they “have not ordered in a while”, you thought they would “really want to know about this wine” etc., that’s why you sent them “a personal (offline?) note”. You dig? Don’t go for stuff like “2 for the price of one” and that kind of thing. That’s not the “real” customer, I don’t think. You want to reactivate customers who are going to continue, not who are going to “buy and run”.

Designing the right offers is the trickiest part of the retention business. Think about the kind of person you are willing to “invest in” – a persona, if you will – and then design an offer that appeals specifically to that customer and not broadly to other customers.

So, to review the suggestion above, you want the offer to be product-focused because you want to attract “true believers”. You want it to be a “special wine” for the same reason; it has a “story” you can use to personally reconnect your business with the customer. And you don’t want to “2 for 1” or other strictly price-driven offers because that’s the wrong audience, they have low potential value, they probably take the offer then never buy again. You can use price, but if you do, include a “kicker” of some kind that shows intent – you have to rejoin, you have to buy over $200 worth, you have to make 3 purchases in the next 6 months, etc.

So, for example, “We want you back as a member. If you rejoin today, I will send you a bottle of this special wine, absolutely free. You pay only shipping and handling”.

See? Psychology of the offer. Design it so it attracts the right kind of person, and make sure they have to put some skin in the game (buy a membership and pay shipping) to ensure you are buying potential (future) value.

Then drop the campaign across all the Recency segments after 3 months in your chart. Use a 10% sample of each segment, for example. Chart where breakeven is, and that segment represents economic defection. Take any money you are spending on customer marketing out past the defection point and plow it into customers with a Recency before the defection / breakeven point.

Fifth, watch the store. An advantage to focusing on the product is even if you don’t get them to reactivate membership, you may sell them some bottles of your special wine anyway – at full price. Hey, nothing wrong with that. That starts a “second LifeCycle”, if you know what I mean, with it’s own attrition rate, it’s own marketing program, etc. Don’t forget to include the profit from these “side sales” in your breakeven – they are paying for the campaign too, even if not for membership.

In the end, what you probably find is that there is a logical, sequential LifeCycle that you can take advantage of, something like:

1. Customer signs up for “membership”. There is marketing that goes along with this, which you seem to do quite well already.

2. Customer cancels “membership”. This is a critical juncture, you want to tell them you “still love them” and they are welcome to buy in the store, let’s say, under a new kind of plan, a different type of “membership”. “As a former member, you will get 10% off on any store

purchases, you get the e-mail update with “Top Picks”, etc. They have to take some kind of affirmative action to get this though, a “sign up”, again, you want “continuers”, not the “buy and run” types that cost you money.

3. Customers who fail to sign up for #2 or sign up and then quit are offered a “Store Specials” kind of thing that basically (I’m guessing) is more self-serving, helps you manage inventory, gooses sales when you need to, and so on.

4. Customer defects economically. At some point, say the 15 month block, you simply get no response to anything you do, or the response is so weak that the campaign does not create enough profit to pay for itself. That’s economic defection of the customer.

Virtually all customers will eventually defect, that’s just the way it is. The key to improving profits is nudging that one or two extra purchases per customer into the system. You multiply that by 100,000 customers and you’re talking real money.

Good luck with it!

Jim

Get the book at Booklocker.com

Find Out Specifically What is in the Book

Learn Customer Marketing Concepts and Metrics (site article list)

Download the first 9 chapters of the Drilling Down book: PDF