So, you’re saying to yourself, all this talk about Control Groups and Measuring dis-Engagement and Relationship Marketing, is there any other reason to care about this stuff besides Campaigns?

Yes – addressing MultiChannel Mayhem – the fact that few companies have a solid plan for really optimizing the multichannel system.

Kevin shows us why MultiChannel Mayhem matters here. Turns out multichannel customers are not always the best customers. Of course, you knew that, right? I mean, you have relationships with multichannel vendors you conduct through a single channel, right? And you would consider yourself a pretty darn good customer, right?

The reason Control Groups, Measuring dis-Engagement, and Relationship Marketing are so important is they comprise an entire MultiChannel Interactive Marketing System. It is pre-built and ready to go, customized to take advantage of and optimize Interactive Customer Relationships, where sometimes the most profitable Marketing is to do none at all.

If you are an analyst / technical background, you would probably be more comfortable studying the system from the bottom up, from the very measurement-oriented idea of Control Groups up through Measuring dis-Engagement to the Marketing Strategy idea of Relationship Marketing – what, how, then why.

If you are a Marketer, you would probably be more comfortable studying the system from the top down, from the Marketing Strategy idea of Relationship Marketing down through?Measuring dis-Engagement to the measurement-oriented idea of Control groups – why, how, then what.

Why should you care about this system? Because addressing the problem of MultiChannel Mayhem is built right into the model, along with all the cultural and organizational tools you need to implement.

Let’s go though a common challenge with Multichannel Marketing and see how the system solves it. First, we need some assumptions:

- The goal is to optimize the MultiChannel system for Return on Marketing Investment?- not sales, not share, etc.

- Given proper measurements, people will make rational decisions.

- The general concept of long-term customer value?is important to the company and people act accordingly

Now, let’s address a common problem – no controls on who uses the customer database or what it is used for. Any division or channel can market to any customer at will, doing whatever it is they want to do, regardless of previous messages.

This is a mess, and you know it. Customers are being bombarded with conflicting brand and offer messages.

Here’s how the above system solves that problem:

1. The division or channel that acquires the customer owns the customer exclusively for some period of time. After all, they started the Relationship, they invested in acquiring the customer, they should get the rewards of the Potential Value they have created. No other divisions are allowed to communicate with the customer without the permission of the acquiring entity.

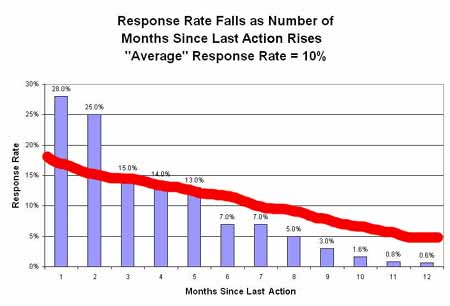

2. The acquiring entity retains this exclusivity to the custome only as long as they can maintain an active Relationship with the customer. Once dis-Engagement has grown significantly, the customer is open season for any division or channel. This is why it is so incredibly important to define and measure the dis-Engagement process. The customer is evolving, and this rule ensures the company is flexibly responding and evolving with the customer, following the Relationship, and maximizing value.

3. After the initial acquisition and subsequent dis-Engagement, whichever channel or division has the most current relationship owns the customer. If a customer defects from one channel to another, the “ownership” passes as well.

4. The channel or division with the most current relationship can at any time sell communication permission (basically, rent the list of customers Engaged with it) to other channels or divisions if it wants to. This is not only a nice way to help offset acquisition costs, it also creates an internal marketplace of relationship permission, where only the communications which generate incremental customer value survive the Controlled Testing process.

If you have to rent a list of new customers from the acquiring entity and pay for that list, you are going to be more thoughtful and careful regarding what kind of communications you send. Realizing that prior communications are going to affect the success of your communications to this rented list, you are going to tend to stay on brand message and within established communications guidelines.

In other words, this construct enforces financially responsible testing.

The rental fees are negotiated between buyer and seller. The seller can charge different fees for access to different segments, for example, known best buyers cost more to rent than predicted dis-Engagers. Any segmentation you want. This is a CPM-based rental fee arrangement to keep list access prices fair across channels. I suppose you could go to CPA, but that’s probably going a bit too far, given the lack of ability for some channels to track such things.

5. If the customer is a true multi-channel customer – active in multiple channels or divisions simultaneously – then all channels the customer is active in have permission to communicate with the customer Any activity with any division or channel – including service requests – indicates Engagement is current and resets the dis-Engagement clock to “Currently Engaged”. This addresses the above scenario Kevin has painted, which is more like the reality of multichannel relationships – they ebb and flow between channels over time.

From the company point of view, this system is a self-regulated, self-optimizing customer value generating machine. It ensures that from whatever channel or division perspective you view the system, the strong survive and the weak fail, but the Potential Value of the customer is always maximized.

6. If, from a Strategic perspective, the Company wants to intervene in this system, that is permitted, as long as there is compensation to the Relationship-generating asset gatherers.

For example, when launching a new channel or product line with no customers to start with and no cash flow. The Company, on behalf of the new channel or line, pays rent to all the other channels for the permission assets they have generated. The channels still get a return on their assets, and for the Company, it’s simply accounting for a real cost – the cost of cannibalizing existing sales in another channel / line or acquiring the customer.

From a practical perspective, whether money actually changes hands or not in the permission marketplace is a company culture thing. The more sophisticated database marketing companies will often force real monetary exchange because they understand customer value so well.

Other companies might simply run debits and credits in a spreadsheet, creating more of a “list exchange” type of scenario but one that still provides controls on (for example) inundating best customers with communications and ignoring defecting customers. These credits can be used to pay for other cross-channel marketing activities as well, for example, the mail order division wants to put catalogs in the web division’s outbound shipments and pays with credits received from the web division’s use of catalog e-mail addresses.

A self-regulating, self-optimizing system for Managing MultiChannel Mayhem, built on Relationship Marketing, Measuring dis-Engagement, and Control Groups to keep everybody in the system honest.

It’s really no different than, say, optimizing a PPC campaign – except it’s only about customer communication, and instead of optimizing across keyword sets and landing pages, you are optimizing across the entire company, every campaign in every channel against each other.

So, do you have Multichannel Mayhem at your company?

If so, does it matter to you or not? Matter to anybody?

If it does matter to you, do you think the system above would address the problems you have?