Jim answers questions from fellow Drillers

(More questions with answers here, Work Overview here, Index of concepts here)

Topic Overview

Hi again folks, Jim Novo here.

Have you ever offered a $100 off coupon to a new retail customer? I have. And guess what? There was no response, even though the average order size across all customers was $38!

So how is this kind of situation possible? Some products attract customers that are only interested in that product, and they are not going to buy again – period. Knowing this, the question for you: is this the kind of product you want to constantly feature / promote?

Guess that depends on the Drillin’, eh? Let’s get to it …

Creating Effective Retention Campaigns

Q: Hi Jim,

Love your newsletters. Do you have a tip jar I can use to donate to the cause?

A: Hmmm…maybe I ought to start one…nah. It all works out in the end!

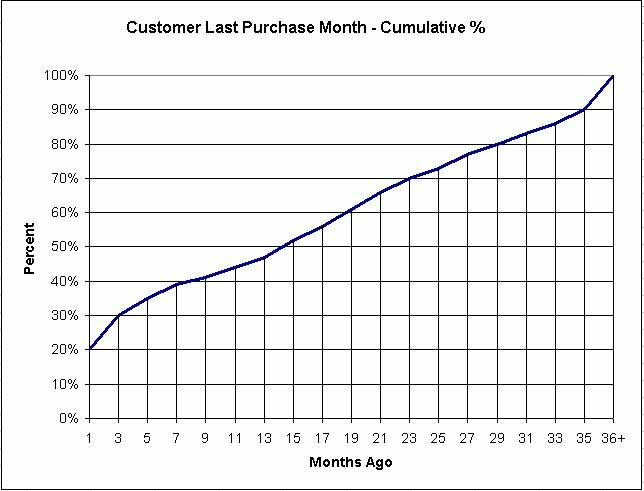

Q: Take a look at this chart I did of cumulative customer purchase Recency (actual numbers changed but the relationships are same): See below for explanation **

** Jim’s Note: How to read the chart:

“In the past 3 months, (“3” on horizontal axis), 30% of our customers have made a purchase (“30%” on vertical axis). In the past 7 months, almost 40% of our customers have made a purchase. Because the last category is “last purchase 36 months ago or longer”, the chart includes all customers – 100%.

Since each customer can have only 1 “most Recent” purchase, each customer is on the chart only once. Therefore, if 40% of customers have made a purchase in the past 7 months, 60% have not made a purchase.

Q: What does this pattern (the % of total by group) tell one generally about the attrition in the business model? It’s interesting, I’ve never looked at this kind of diagram before. For our business (wine retailer with “club” option), I generally consider anyone with a transaction in the past 12 months to still be a customer.

Continue reading Creating Effective Retention Campaigns