Jim answers questions from fellow Drillers

(More questions with answers here, Work Overview here, Index of concepts here)

Topic Overview

Hi again folks, Jim Novo here.

Subsidy costs. You’re just starting to hear people talk about these ideas in online marketing, but they’ve been around for years offline in direct marketing. The basic idea is this: sending a discount to someone who is very highly likely to make a purchase without the discount is a waste of margin dollars best spent elsewhere. And you can measure this effect quite easily using Control Groups, another concept starting to get some recognition with online marketers.

Discussing / implementing these topics can be a bit difficult, though the Finance people will get it immediately and love it if you go in this direction. A plus for fellow Drillers out there is you can start to see some of these ideas in action BEFORE you start going deep using the RFM & Lifecycle data we’ve been talking about and using for years.

Below is a great example using RFM data from a fellow Driller. You ready to go ?

Q: Since our last conversation few months ago, we went ahead and tested 3 different promotions using the RFM model.

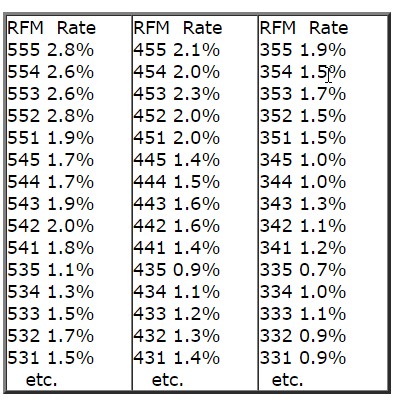

The 1st promotion was the test for RFM method itself to see what patterns emerge for response rate, incremental sales, etc. The next 2 promotions targeted the customers from RFM cells with the highest incremental lift from the 1st test promotion. Here is what we saw. Since the targeted audience were our loyalty card members, they transact and spend at a fairly high level (the data below is modified but the trend is maintained). For the response rate, we saw a sawtooth pattern:

(Jim’s note: RFM is the 3 digit score, Rate is Response Rate. More on RFM here and here.)

A: Yes…

Continue reading Using RFM Scores to Predict Profits